Recently, it can be seen from the naked eye that the policy support for the supply and sales of real estate is increasing. Stimulated by this aspect, it also directly boosted the confidence of the steel industry. Although the steel products such as deformed steel bars and hot-rolled coils are critical to the Spring Festival, the volume of turnover has declined significantly, but the price has risen steadily.

As an indispensable consumable material in the steel industry, refractory materials have also won the favor of many investors. For example, the share price of Punai (002225) also climbed out of the trough at the end of last year and has risen by 8% so far, realizing a strong recovery.

Change in share price of Punai

Refractory, in fact, refers to inorganic non-llic materials that can withstand high temperatures above 1580 ℃, which are usually used as structural materials for high-temperature kilns, and can be said to be the escort of high-temperature industry.

But it is the refractory material with an annual output of more than 24 million tons, and this year's life is really difficult. For example, Beijing Lear (002392), one of the industry leaders, saw its revenue and net profit attributable to its parent company fall by 1.8% and 24.8% respectively in the first three quarters of last year. Sinosteel Luonai (688119) is not much better. The net profit attributable to the parent company in the first three quarters fell by 7.9% year on year.

Therefore, the recovery of refractory materials in early 2023, in my opinion, is really another village, ushering in a new turn. Is this trend really sustainable? Is it a good time to get on the bus now? The author brings you to explore.

1、 When will the industry accelerate concentration

If we split the refractory industry chain, you will further deepen your understanding of this small and beautiful market. The upstream raw materials are mainly bauxite and magnesite, while the downstream raw materials can be applied to the high-temperature industry. About 65% of them will be used in the steel industry, so the two are basically strong binding.

Refractory industry chain

It is also by virtue of the advantages of upstream raw materials that China has occupied the first place in the production of refractory materials for many years, accounting for about 65% of the world's total, and its production trend is also closely related to the steel industry. In 2013-2017, under the background of the continuous deepening of the supply-side reform, the demand for fire-resistant materials has declined all the way, and even nearly fell below the 20 million tons mark. In the past five years, the output has been in a relatively stable and rising situation.

Production of crude steel and refractory

Against the background of no bright spot in domestic demand, export sales have become the main growth point of refractory materials. In 2021, the total export trade reached 4.5 billion US dollars, up 54% year on year, while in the first three quarters of last year, it rose 33% year on year. This is not only due to the international sanctions against Russia, but also reflects the continuous improvement of the independent substitution ability of domestic ps and the steady improvement of international competitiveness.

Is there an absolute industry leader in such a market with a revenue of 100 billion? The answer is no. According to the author's incomplete statistics, there are more than 1800 ps of refractory materials in China, five of them have more than 3 billion yuan of operating revenue, and CR10 (the market share of the top ten) is less than 15%. If you compare with foreign countries, you can find that in the European market, the market share of old-brand ps such as Ogilvy and Vesuvius has exceeded 60% by virtue of their advantages in scale, technology and product structure.

Refractory competition

Therefore, in the future, in this large stock market, one of the biggest trends in the past two years is the increase of industry concentration. CR3 has increased by 5% in five years. On the one hand, the industry competition is too fierce, leading to many small and medium-sized ps starting to clear up. On the other hand, the business model is also continuously optimized (we will talk about this later).

Keep an eye on the leader and become the golden key to invest in the track.

2、 Find increment in stock

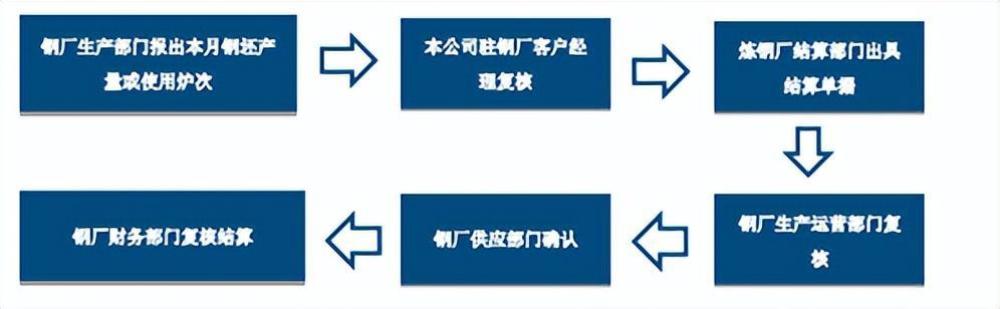

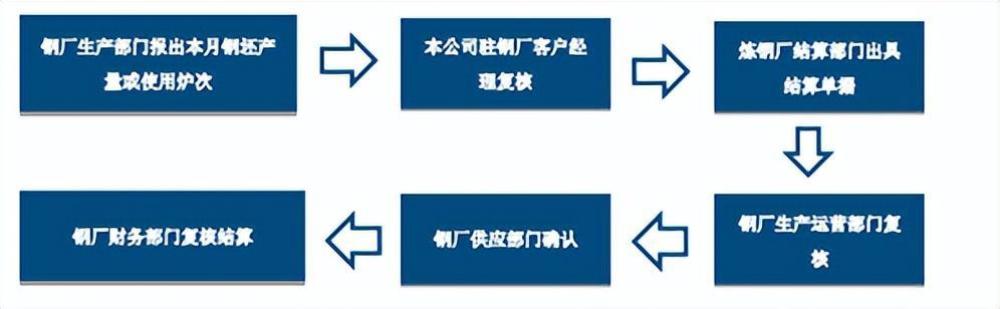

At present, the preferred business model in the refractory industry is overall contracting. How to understand? That is to say, the settlement method with steel ps has changed from selling materials directly to settling according to tons of steel, which puts forward higher requirements for the lean management of refractory ps, but also can achieve a win-win situation between upstream and downstream. From the development in recent years, the proportion of such overall contracting has exceeded 70%.

Overall contracting mode

From the perspective of product structure, as countries are strengthening the energy conservation research of refractory materials to improve the energy conservation and consumption reduction level and production efficiency of high-temperature industry, it can be expected that the consumption of refractory materials per unit product will continue to decline in the near future, which is not a good signal for refractory ps.

However, the so-called "organic in danger" and "changeable in danger" have also forced refractory materials to develop in the direction of longevity and energy conservation, which can be regarded as a way for ps to transform.

For example, functional refractories in refractories, which should be the products with relatively high technical content in refractories, are mainly used in refining and continuous casting technology in the steel industry, and can play a very important role in the quality of steel making.

In addition, driven by the dual-carbon goal, green refractories (such as amorphous refractories) can be recycled and reused after use, which will also become an important increment.

Finally, the automation and digital development of refractory production equipment can also significantly improve production efficiency and product quality.

Therefore, although the overall scale of refractory materials in the future is difficult to be significantly improved, the three directions mentioned by the author become the "golden key" for refractory ps to move to the top of the pyramid.

3、 People in the Jianghu cannot help themselves

Having said so much about refractory materials, in the final analysis, it mainly depends on the demand of the steel industry as an important downstream industry? Whether you can hold your thigh is very important.

Looking ahead to the steel industry this year, it is expected that the double control of production capacity and output in the steel industry will continue further, which is of great significance to the realization of "carbon peak" in the industry. The performance of the industry's prosperity is more d on the demand for real estate. With the "three arrows", the inflection point of the improvement of the financing environment of real estate developers is confirmed, and the demand for real estate is expected to recover this year.

The improvement of demand is on the one hand, and on the other hand, the carbon reduction of the steel industry, such as ultra-low emission transformation, green technology transformation, and so on. Looking back upstream, it will certainly push the refractory ps to transform to green production, which are mutually reinforcing.

Therefore, a healthy industrial chain is not a life-and-death relationship, but a cake for everyone. In the foreseeable future, it is expected that the recovery of refractory materials is imperative.

Note: This document does not constitute any investment proposal. There are risks in the stock market, so we need to be cautious when entering the market. No business, no harm.